Preliminary Proxy Statement Dated October 4, 2016

SubjectWilmington Funds

Wilmington Large-Cap Strategy Fund

Wilmington International Fund

Wilmington Enhanced Dividend Income Strategy Fund

Wilmington Global Alpha Equities Fund

Wilmington Real Asset Fund

Wilmington Broad Market Bond Fund

Wilmington Municipal Bond Fund

Wilmington New York Municipal Bond Fund

Wilmington U.S. Government Money Market Fund

Wilmington U.S. Treasury Money Market Fund

(Each a “Fund,” and collectively, the “Funds”)

1100 North Market Street

9th Floor

Wilmington, DE 19890

1-800-836-2211

January 3, 2024

Dear Shareholder:

I am writing to Completion

let you know that a special meeting of shareholders of the Wilmington Funds (the “Trust”) will be held at 2:00 pm Eastern Time on February 15, 2024, at the Trust’s principal executive offices at 1100 North Market Street, 9th Floor, Wilmington, DE 19890. The informationpurpose of the meeting is set forth in this Preliminary Proxy Statement is not complete and may be changed. Please read the Definitive Proxy Statement when it becomes available.

WILMINGTON MULTI-MANAGER ALTERNATIVES FUND

Aformal Notice of Special Meeting of Shareholders

of Wilmington Multi-Manager Alternatives Fund (the "Fund"),following this letter. Included with this letter are the notice, a

series of Wilmington Funds (the "Trust"), will be held on November 30, 2016,proxy statement and a proxy card.Your vote is very important to vote on two important proposals that affect the Fund. Please read the enclosed materials and cast your vote on the proxy card or voting instruction form.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call you to solicit your vote.

The proposals for the Fund have been carefully reviewed by the Trust's Board of Trustees (the "Board"). The Trustees of the Trust, most of whom are not affiliated with Wilmington Funds Management Corporation (the "Investment Advisor") or its affiliates, are responsible for looking after your interests as a shareholder of the Fund. The Board unanimously recommends that you vote FOR the proposals.

Voting is quick and easy. Everything you need is enclosed. us. To cast your vote, simply complete the proxy card or voting instruction form enclosed in this package. Be sure to sign the card or the form before mailing it in the postage-paid envelope. If eligible, youYou may also vote your shares by touch-tone telephone or through the Internet.telephone. Simply call the toll-free number or visiton your proxy card, enter the web sitecontrol number found on the card, and follow the recorded instructions. You may also vote your shares via the internet. Simply go to the website indicated on your proxy card, or voting instruction form,enter the 12-digit control number found on the front of your proxy card, and follow the instructions.

instructions to cast your vote. If we do not hear from you after a reasonable amount of time, you may receive a call from our proxy solicitor, Broadridge Financial Solutions, Inc., reminding you to vote.If you have any questions before you vote, please call Wilmington Funds Shareholder Services toll-free at 1-800-836-2211. We'll be glad to help you get your vote in quickly. Thank you for your participation in this important initiative.

Very truly yours,

Eric W. Taylor

President, Wilmington Funds

The following Q&AWilmington Funds

Wilmington Large-Cap Strategy Fund

Wilmington International Fund

Wilmington Enhanced Dividend Income Strategy Fund

Wilmington Global Alpha Equities Fund

Wilmington Real Asset Fund

Wilmington Broad Market Bond Fund

Wilmington Municipal Bond Fund

Wilmington New York Municipal Bond Fund

Wilmington U.S. Government Money Market Fund

Wilmington U.S. Treasury Money Market Fund

(Each a “Fund,” and collectively, the “Funds”)

1100 North Market Street

9th Floor

Wilmington, DE 19890

1-800-836-2211

NOTICE OF SPECIAL MEETING OF

SHAREHOLDERS TO BE HELD ON

February 15, 2024

To Our Shareholders:

Notice is provided to assist you in understanding the proposals for the Fund. The proposals are described in greater detail in the enclosed proxy statement. We appreciate your trust in the Fund and look forward to continuing to help you achieve your financial goals.

Important information to help you understand and vote on the proposals

Below ishereby given that a brief overviewspecial meeting of the proposals. The proxy statement provides more information on the proposals. Your vote is important, no matter how large or small your holdings may be.

What are the proposals I am being asked to vote on?

Proposal 1:Shareholdersshareholders of the Fund are being asked to vote to approve modifications to the Fund's current fundamental investment goal.

Proposal 2:ShareholdersFunds of the Fund are being asked to approve the reclassification of the investment goal of the Fund from a fundamental investment policy to a non-fundamental investment policy.

Has the Board approved the proposals?

Yes. The Board has unanimously approved each proposal and recommends that you vote to approve each proposal for the Fund.

Why am I being asked to approve modifications to the Fund's investment goal?

As discussed in more detail in the Proxy Statement, Investment Advisor has concluded that the Fund's pursuit of its current investment goal through its multi-strategy/multi-manager structure is not conducive to the Fund's growth or competitive performance. Investment Advisor has determined that the Fund should change its investment goal and retain a single unaffiliated subadviser (subject to shareholder approval of the revised investment goal), Wellington Management Company LLP ("Wellington"), which would allocate and reallocate the Fund's assets among a number of global equity strategies managed by portfolio management teams within Wellington. Wellington would also use a portion of the Fund's assets to seek to reduce, or hedge, a portion of the equity market risk generated by the portfolio.

The current investment goal of the Fund is to seek "to achieve long term growth of capital through consistent returns from investments that have a low correlation to traditional asset classes." As a result of implementing the new investment strategy with Wellington, the Fund's portfolio would in fact have a higher correlation to the markets in which it invests, with hedging that is designed to reduce the sensitivity of the portfolio to market movements. The Fund's investment goal is a "fundamental" policy, which means that it cannot be changed without shareholder approval. Therefore, the Board unanimously recommends that shareholders approve changing the Fund's investment goal to: "to achieve long-term growth of capital with lower volatility than the broader equity markets." The Investment Advisor believes that changing the investment goal is in the best interests of the Fund because the change will enable the Fund to pursue the new investment strategy with Wellington as the single subadviser, offering the Fund the prospect for improved performance and the potential for growth in assets.

What effect will changing the Fund's investment goal have on the Fund?

Changing the investment goal will allow the Fund to pursue the new investment strategy with Wellington as the sole subadviser, as described in the previous Q&A. Investment Advisor anticipates that the Fund will experience an immediate and significant decrease in its net expense ratio (from 2.49% to 1.25% for Class I shares) as a result of hiring a single subadviser. Investment Advisor believes that the restructured Fund will represent a unique offering with a competitive net expense ratio and the prospect for improved performance.

In conjunction with the proposed changes to the Fund's investment goal, the Investment Advisor has proposed, and the Board has unanimously approved, the following changes, subject to shareholder approval of the revised investment goal: (i) changing the Fund's name to reflect the Fund's proposed revised investment mandate; and (ii) changing certain principal investment strategies of the Fund. The proposed name and investment strategy changes do not require shareholder approval.

Why am I being asked to approve the reclassification of the investment goal from "fundamental" to "non-fundamental"?

Q&A

1

The reclassification of the investment goal from "fundamental" to "non-fundamental" would permit the Board to amend the Fund's investment goal in the future without shareholder approval when the Board believes that the change is in the best interests of shareholders, without incurring the cost and delay of calling a meeting of shareholders.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each share (and a proportionate fractional vote for each fractional share) you own of the Fund on the record date. The record date is October 13, 2016.

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card or voting instruction form and mailing it in the enclosed postage-paid envelope. If eligible, you may also vote using a touch-tone telephone by calling the toll-free number printed on your proxy card or voting instruction form and following the recorded instructions or through the Internet by visiting the web site printed on your proxy card or voting instruction form and following the on-line instructions. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call 1-800-836-2211.

How do I sign the proxy card?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the proxy card or voting instruction form.

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name appearing on the account registration as shown on the proxy card or voting instruction form.

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, "Ann B. Collins, Trustee."

Q&A

2

WILMINGTON MULTI-MANAGER ALTERNATIVES FUND

(a series of Wilmington Funds)

IMPORTANT SHAREHOLDER INFORMATION

These materials are for a Special Meeting of Shareholders of Wilmington Multi-Manager Alternatives Fund (the "Fund"), a series of Wilmington Funds (the "Trust"“Trust”), which will be held at 111 S. Calvert2:00 pm Eastern Time on February 15, 2024, at the Trust’s principal executive offices at 1100 North Market Street, 269th Floor, Baltimore, Maryland 21202, on Wednesday, November 30, 2016, at 3:00 p.m., Eastern time.Wilmington, DE 19890 (the “Meeting”). The enclosed materials discuss the proposals (the "Proposals") to be voted on at the meeting, and contain the Notice of Special Meeting of Shareholders, proxy statement and proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on an important issue relating to the Fund. If you specify a vote on the Proposals, your proxy will be voted as you indicate. If you simply sign, date and return the proxy card, but do not specify a vote on the Proposals, your proxy will be voted "FOR" the Proposals.

We urge you to review carefully the Proposals described in the proxy statement. Then, please fill out and sign the proxy card or voting instruction form and return it to us so that we know how you would like to vote. When shareholders return their proxies promptly, additional costs of having to conduct additional mailings may be avoided. PLEASE COMPLETE, SIGN AND RETURN your proxy card or voting instruction form.

We welcome your comments. If you have any questions, call 1-800-836-2211.

TELEPHONE AND INTERNET VOTING

For your convenience, you may be able to vote by telephone or through the Internet, 24 hours a day. If your account is eligible, instructions are enclosed.

|

WILMINGTON MULTI-MANAGER ALTERNATIVES FUND

(a series of Wilmington Funds)

111 South Calvert Street, 26th Floor

Baltimore, Maryland 21202

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

The Board of Trustees of Wilmington Funds (the "Trust"), on behalf of Wilmington Multi-Manager Alternatives Fund (the "Fund"), has called a Special Meeting of Shareholderspurpose of the Fund (the "Meeting"), which will be held at 111 S. Calvert Street, 26th Floor, Baltimore, Maryland 21202, on Wednesday, November 30, 2016 at 3:00 p.m., Eastern time.

During the Meeting shareholders of the Fund will be askedis to vote on the following proposals:

| 1. | To approve modifications to the Fund's current fundamental investment goal. |

| 2. | To approve reclassification of the Fund's investment goal from a fundamental investment policy to a non-fundamental investment policy. |

| 3. | To transact such other business, if any, as may properly come before the Meeting. |

[October 19, 2016] | By Order of the Board of Trustees,

Lisa R. Grosswirth

Secretary, Wilmington Funds

______, 2016

|

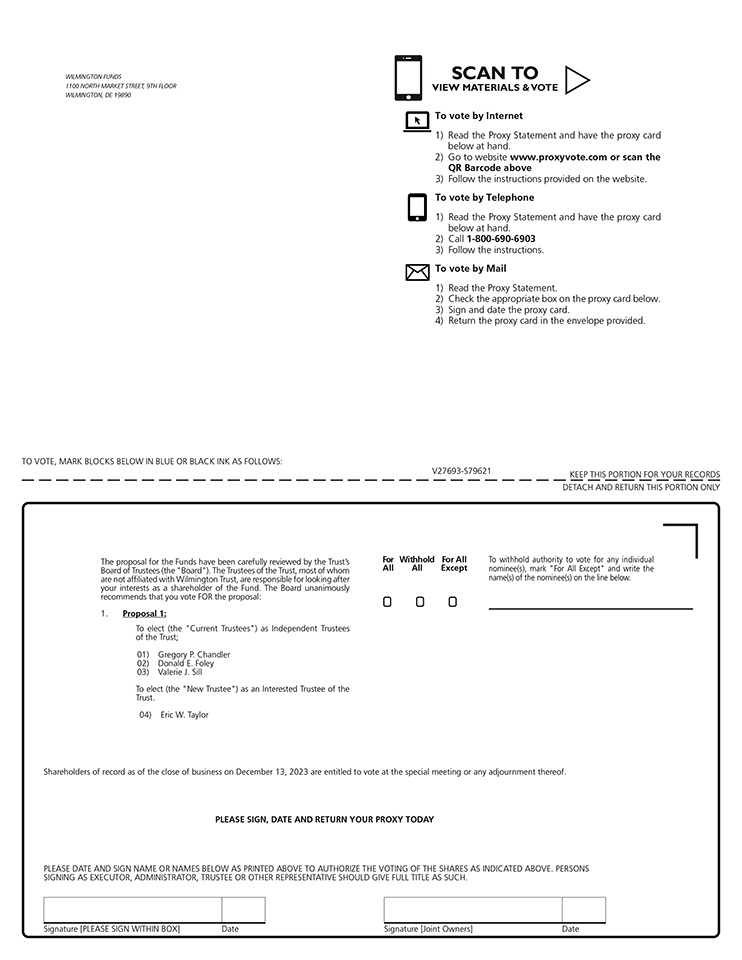

Please signproposal:1. To elect Gregory P. Chandler, Donald E. Foley, and promptly returnValerie J. Sill as Independent Trustees of the proxy cardTrust, and Eric W. Taylor as an Interested Trustee of the Trust (together, the “Current Trustees”).

It is not anticipated that any matters other than that listed above will be brought before the Meeting. If, however, any other business is properly brought before the Meeting, proxies will be voted in accordance with the judgment of the persons designated as proxies or voting instruction formotherwise as described in the enclosed self-addressed envelope regardless of the number of shares you own.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL SHAREHOLDER MEETING TO BE HELD ON NOVEMBER 30, 2016

The Notice of Special Meeting of Shareholders, proxy statement and form of proxy card are available on the Internet at [website]. The form of proxy card on the Internet site cannot be used to cast your vote.

|

If you have any questions about how to vote or about the Meeting, or wish to obtain directions to be able to attend the Meeting and vote in person, please call 1-800-836-2211.

PROXY STATEMENT

TABLE OF CONTENTS

|

| Page

|

INFORMATION ABOUT VOTING | |

THE PROPOSALS | |

PROPOSAL 1: TO APPROVE MODIFICATIONS TO THE FUND'S CURRENT FUNDAMENTAL INVESTMENT GOAL | |

PROPOSAL 2: TO APPROVE RECLASSIFICATION OF THE FUND'S INVESTMENT GOAL FROM A FUNDAMENTAL INVESTMENT POLICY TO A NON-FUNDAMENTAL INVESTMENT POLICY | |

ADDITIONAL INFORMATION ABOUT THE FUND | |

FURTHER INFORMATION ABOUT VOTING AND THE MEETING | |

Exhibit AOUTSTANDING SHARES AND CLASSES OF THE FUND AS OF THE RECORD DATE (OCTOBER 13, 2016)

| A-1 |

Exhibit BPRINCIPAL HOLDERS OF FUND SHARES AS OF THE RECORD DATE (OCTOBER 13, 2016)

| B-1 |

WILMINGTON MULTI-MANAGER ALTERNATIVES FUND

(a series of Wilmington Funds)

PROXY STATEMENT

♦ INFORMATION ABOUT VOTING

Who is asking for my vote?

The Board of Trustees (the "Board" or the "Trustees") of Wilmington Funds (the "Trust"), on behalf of Wilmington Multi-Manager Alternatives Fund (the "Fund"), in connection with a Special Meeting ofattached Proxy Statement. Shareholders of therecord of each Fund to be held on Wednesday, November 30, 2016 (the "Meeting"), have requested your vote on important matters (the "Proposals").

Who is eligible to vote?

Shareholders of record at the close of business on

Thursday, OctoberDecember 13,

2016 (the "Record Date")2023 are entitled to

be presentnotice of, and to vote at,

theany such Meeting

or any adjourned Meeting. Each share of record of the Fund is entitledand adjournments thereof.You are cordially invited to one vote (and a proportionate fractional vote for each fractional share) on each matter relating to the Fund presented atattend the Meeting. The Notice of Special Meeting of Shareholders are requested and encouraged to complete, date and sign the enclosed proxy card and return it promptly in the proxy statement were first mailed to shareholders of record on or about [October 21, 2016].

On what issues am I being asked to vote?

Shareholders are being askedpostage-paid envelope provided for that purpose. Alternatively, to vote on the following Proposals:

Proposal 1: To approve modificationsvia telephone or internet, please refer to the Fund's current fundamental investment goal;enclosed proxy card. If you intend to attend the Meeting in person, you may register your presence with the registrar and

| Proposal 2: | To approve reclassification of the Fund's investment goal from a fundamental investment policy to a non-fundamental investment policy. |

How does vote your shares in person, even if you have previously voted your shares by proxy. If you properly execute and return the Board recommend that I vote?

The Board, on behalf of the Fund, unanimously recommends that you vote FOR the approval of the Proposals.

How do I ensure that my vote is accurately recorded?

You may submit yourenclosed proxy card or voting instruction form in one of four ways:

| · | By Internet (if eligible). The web address and instructions for voting can be found on the enclosed proxy card or voting instruction form. You will be required to provide your control number located on the proxy card or voting instruction form. |

| · | By Telephone (if eligible). The toll-free number for telephone voting can be found on the enclosed proxy card or voting instruction form. You will be required to provide your control number located on the proxy card or voting instruction form. |

| · | By Mail. Mark the enclosed proxy card or voting instruction form, sign and date it, and return it in the postage-paid envelope we provided. |

| · | In Persontime to be voted at the Meeting,. You can vote your shares in person at the Meeting. |

Shareholders of record who hold shares directly with the Fund are eligible to vote by Internet or by telephone. If you hold your shares with a broker or other financial intermediary, whether you are eligible to submit your voting instructionsrepresented by Internet or by telephone will depend upon the proxy voting services provided by such broker or other financial intermediary. If you require additional information regarding the Meeting, you may contact 1-800-836-2211.

1

Proxy cards that are properly signed, dated and received at or prior to the Meeting will be voted as specified. If you specify a vote on the Proposals, your proxy will be voted as you indicate. If you simply sign, dateat the Meeting in accordance with your instructions. Unless revoked, proxies that have been executed and return the proxy card, but do not specify a vote on the Proposals, your proxyreturned by shareholders without instructions will be voted "FOR" the Proposals.

May I revoke my proxy?

You may revoke your proxy at any time before it is voted by forwarding a written revocation or a later-dated proxy to the Fund that is received by the Fund at or prior to the Meeting, or by attending the Meeting and voting in person.

What if my shares are held in a brokerage account?

If your shares are held by your broker, then in order to vote in person at the Meeting, you will need to obtain a "legal proxy" from your broker and present it to the Inspector of Elections at the Meeting. Also, in order to revoke your proxy, you may need to forward your written revocation or a later-dated proxy card to your broker rather than to the Fund.

2

♦ PROPOSAL 1:TO APPROVE MODIFICATIONS TO THE FUND'S CURRENT FUNDAMENTAL INVESTMENT GOAL

The Board unanimously recommends that the shareholdersfavor of the Fund approve changing the Fund's current fundamental investment goal to read as follows: to achieve long-term growthproposals.

The enclosed proxy is being solicited on behalf of capital with lower volatility than the broader equity markets.

Why am I being asked to approve modifications to the Fund's fundamental investment goal?

The current investment goal of the Fund is to seek "to achieve long-term growth of capital through consistent returns from investments that have a low correlation to traditional asset classes." Since its inception, the Fund has sought to achieve that goal using a multi-manager, multi-strategy investment process, meaning that the Fund has employed a number of unaffiliated subadvisers (currently six), each pursuing its own particular alternative or non-traditional (i.e., hedge fund) strategy, overseen by Wilmington Funds Management Corporation (the "Investment Advisor") and the Fund's primary subadviser, Wilmington Trust Investment Advisors, Inc. ("WTIA"), which is affiliated with Investment Advisor. The Investment Advisor has concluded that it is in the best interests of the Fund to use a single unaffiliated subadviser, executing the alternative investment strategy described below, and to change the investment goal to correspond to the new investment strategy.

In particular, after reviewing various options, the Investment Advisor has concluded that it would be preferable to retain a single unaffiliated subadviser (subject to shareholder approval of the revised investment goal), Wellington Management Company LLP ("Wellington"), which would allocate and reallocate the Fund's assets among a number of global equity strategies managed by various different portfolio management teams within Wellington. Wellington's allocations among those strategies will be based on objectives and guidelines specified by, or developed in consultation with WTIA, and under the supervision of the Investment Advisor. Wellington would use a portion of the Fund's assets to seek to reduce, or hedge, a portion of the equity market risk generated by the portfolio.

As a result of implementing the new investment strategy with Wellington, the Fund's portfolio will in fact have a higher correlation to the markets in which it invests, with the hedging designed to reduce the sensitivity of the portfolio to market movements. Therefore, the investment goal must be changed. The Fund's investment goal is a "fundamental" policy, which means that it cannot be changed without shareholder approval. The Board is recommending that shareholders approve changing the Fund's investment goal to: "to achieve long-term growth of capital with lower volatility than the broader equity markets."

What are the proposed modifications to the Fund's investment goal?

The Fund's investment goal is proposed to be changed as follows:

Current Investment Goal | Proposed Investment Goal |

To achieve long-term growth of capital through consistent returns from investments that have a low correlation to traditional asset classes | To achieve long-term growth of capital with lower volatility than the broader equity markets |

What effects will changing the Fund's investment goal have on the Fund?

If (and only if) the proposed change to the Fund's investment goal is approved by shareholders, the Fund will undergo a restructuring. The restructuring includes: (i) changing the Fund's name to reflect the Fund's proposed revised investment mandate; and (ii) implementing new principal investment strategies for the Fund using Wellington as the sole unaffiliated subadviser. In addition, the Fund's net expense ratio will be reduced from 2.49% to 1.25% (for Class I shares) due to the lower investment advisory fees that will be payable to Wellington by the Fund compared to the higher fees that are payable by the Fund to its current unaffiliated subadvisers. The proposed name and investment strategy changes do not require shareholder approval.

3

Under the new principal investment strategy, Wellington will construct an actively managed, globally diversified portfolio of equity securities, and implement an index-based hedging strategy in an effort to reduce the severity of portfolio losses in times of market downturns.

The Fund will invest in a portfolio of global equity securities, including common stock, preferred stock and depositary receipts, of companies of all market capitalizations. Up to 60% of the equity portfolio may be invested in non-U.S. issuers, including emerging markets. Based on the parameters developed by WTIA, Wellington will allocate and reallocate the portfolio among a selection of independent equity management teams within Wellington. Each team pursues its own investment strategy or style, such as geography/region, growth/value, market capitalization, event-driven, economic sector, industry, or valuation measure. In combining strategies, Wellington uses a number of proprietary analytical tools, including market environments analysis, extreme events analysis, stress testing, and simulation analysis. Through the strategy selection process, Wellington seeks to construct a portfolio comprised of a diversified group of long-only equity strategies with differing investment approaches that provide an overall exposure comparable to the broader equity markets, and that reduces exposure to the risks typically associated with any single investment approach. The underlying equity management teams have complete discretion and responsibility for security selection and portfolio construction decisions within their respective portions of the Fund's portfolio and subject to the constraints of the Fund's investment goal, strategies and restrictions. The Fund may engage in active and frequent trading as part of its principal investment strategy. The Fund's broad-based securities market index (i.e., its benchmark) will be the HFRX Equity Hedge Index.

Wellington will implement the hedging strategy by investing a portion of the Fund's net assets in futures contracts on broad-based equity indexes, the constituents of which include the types of securities in which the Fund invests directly, and in cash, cash equivalents and short-term debt instruments to satisfy applicable margin and asset segregation requirements. The net market exposure (sum of long and synthetic short positions including cash) of the Fund is expected to range between 20% to 60% of the net asset value of the Fund, depending on Wellington's analysis of prevailing market conditions, although the exposure may fall outside of this range. Wellington may also invest in a variety of other derivative instruments, such as swaps, forwards, other futures contracts and options, in order to implement the hedging strategy, to hedge foreign currency risk, and to gain equity-like exposure in certain markets. Thus, the new strategy will be substantially similar, in effect, to an equity long/short strategy.

The new strategy is designed to have lower volatility than the markets in which it invests, seeking to preserve capital in down markets and, over a full market cycle, generally to keep pace in rising markets. The Investment Advisor does not anticipate any operational issues with implementing the futures positions under the Fund's derivatives policy, or with administering the equity portfolio.

Additionally, the Fund will change its name to the "Wilmington Global Alpha Equities Fund."

All or substantially all of the Fund's portfolio will turn over as a result of the restructure. The Investment Advisor will hire a transition manager to assist it, at an estimated cost of $175,000. Trading costs of the restructure are included in the transition manager fee. The transition manager fee will be borne by the Fund.

A complete liquidation of the Fund's portfolio as of August 31, 2016, would generate approximately $4.4 million in gains that would be completely offset by the Fund's capital loss carry forwards. Accordingly, the restructure will not generate a capital gains distribution for shareholders.

The Investment Advisor believes that the restructure of the Fund, as described above, will result in a unique, compelling and competitive product that will be a desirable element in client portfolios. At the time that the transition to Wellington is complete (assuming shareholder approval), the Investment Advisor expects that the Fund will be the only U.S. mutual fund subadvised by Wellington dedicated wholly to the new investment strategy (although the Fund has no exclusive rights to the strategy). The Board and the Investment Advisor believe that the immediate reduction in the net expense ratio, coupled with the prospect for better performance, justify the Fund bearing the expenses of the restructure.

Will there be changes to the Fund's subadvisers as a result of the proposed change to the Fund's investment goal?

4

As described above, pending shareholder approval of the proposed investment goal, the Investment Advisor anticipates transitioning to Wellington as the sole unaffiliated subadviser by the end of 2016 or early in 2017. On September 15, 2016, the Board of Trustees of the Trust approved Wellington as a subadviser to(the “Board” or the Fund.

Wellington is an 88-year old, global investment management firm, with aggregate assets under management“Trustees”), on behalf of over $950 billion at June 30, 2016. Wellington is headquartered in Boston, Massachusetts, and has 13 offices across the world. Wellington manages equity, fixed income and alternative investment strategies in separate accounts and private funds for all types of investors, and as a subadviser to mutual funds. Wellington does not sponsor its own mutual funds. Pursuant to an exemptive order from the SEC, the Investment Advisor (subject to the approval of the Board) may, with respect to the Fund, select and replace sub-advisors, which are unaffiliated with the Investment Advisor, and amend Sub Advisory agreements, without obtaining shareholder approval, provided that certain conditions are met. Hiring Wellington as the subadviser to the Fund does not require shareholder approval. If Proposal 1 is approved by shareholders, the Fund will continue to rely on the SEC exemptive order and could, in the future, add one or more additional unaffiliated subadvisers in reliance on the SEC exemptive order, although there is no current intention to do so.

What is the required vote on Proposal 1?

Proposal 1 must be approved by shareholders representing the lesser of: (A) at least 67% of the outstanding voting securities of the Fund present at the meeting, if holders of more than 50% of the outstanding voting securities of the Fund are present (in person or by proxy) at the meeting; or (B) more than 50% of the outstanding voting securities of the Fund (a "1940 Act Vote").

If Proposal 1 is not approved by shareholders of the Fund, then the Fund will continue to be managed in accordance with its current investment goal, and with its current unaffiliated subadvisers, and the Investment Advisor and the Board will consider what steps to take with respect to the ongoing management of theeach Fund. If approved by shareholders of the Fund, the proposed investment goal would become effective on or about [January 31, 2017].

THE BOARD UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE "FOR" PROPOSAL 1.

♦ PROPOSAL 2:TO APPROVE RECLASSIFICATION OF THE FUND'S INVESTMENT GOAL FROM A FUNDAMENTAL INVESTMENT POLICY TO A NON-FUNDAMENTAL INVESTMENT POLICY

The Board unanimously recommends that the shareholders of the Fund approve reclassificationFunds vote FOR the proposal.

By order of the Fund'sBoard of Trustees,

Lisa R. Grosswirth

Secretary, Wilmington Funds

January 3, 2024

Wilmington Funds

Wilmington Large-Cap Strategy Fund

Wilmington International Fund

Wilmington Enhanced Dividend Income Strategy Fund

Wilmington Global Alpha Equities Fund

Wilmington Real Asset Fund

Wilmington Broad Market Bond Fund

Wilmington Municipal Bond Fund

Wilmington New York Municipal Bond Fund

Wilmington U.S. Government Money Market Fund

Wilmington U.S. Treasury Money Market Fund

(Each a “Fund,” and collectively, the “Funds”)

PROXY STATEMENT DATED

JANUARY 3, 2024

SPECIAL MEETING OF

SHAREHOLDERS TO BE HELD

ON

FEBRUARY 15, 2024

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or “Trustees”) of the Wilmington Funds (the “Trust”), on behalf of the Funds, for use at a special meeting of shareholders to be held at the Trust’s principal executive offices at 1100 North Market Street, 9th Floor, Wilmington, DE 19890, on February 15, 2024 at 2:00 pm Eastern Time, or at such later time made necessary by any and all adjournments or postponements thereof (the “Meeting”). This Proxy Statement, the Notice of Special Meeting and the proxy card are being mailed to shareholders of the Funds on or about January 10, 2024.

Each Fund provides periodic reports to its shareholders, which highlight relevant information about the Funds, including investment goalresults and a review of portfolio investments. You may receive an additional copy of the most recent annual report of a Fund and the most recent semi-annual report succeeding the annual report upon request without charge, by calling 1-800-836-2211, by downloading it from a fundamental policythe Trust’s website at www.wilmingtonfunds.com or by writing to a non-fundamental policy.

Why am I beingWilmington Funds, 1100 North Market Street, 9th Floor, Wilmington, DE 19890.INTRODUCTION AND SUMMARY OF THE PROPOSAL

At the Meeting, each shareholder of the Trust will be asked to approve reclassificationelect the following Trustees to hold office during the continued lifetime of the Fund's fundamental investment goal?

Under applicable law,Trust until he or she dies, resigns, retires, is declared bankrupt or incompetent by a

mutual fund's investment goalcourt of appropriate jurisdiction, or is

not requiredremoved, or, if sooner than any of such events, until the next meeting of shareholders called for the purpose of electing Trustees and until his or her successor is duly elected and qualified: Gregory P. Chandler, Donald E. Foley, Valerie J. Sill, and Eric W. Taylor (the “Current Trustees”).The Board has determined to be fundamental. The Fund's current investment goal is fundamental, which meansrequest that shareholders needelect the Current Trustees because Ms. Sill and Mr. Taylor have been serving as Trustees since 2020 and 2022, respectively, but have not previously been elected by shareholders. Mr. Chandler and Mr. Foley have previously been elected by shareholders of the Trust.

1

The shareholders of each of the Funds comprising separate series of the Trust will be entitled to approve any material changevote at the Meeting on the proposal being presented for shareholder consideration. Pursuant to the investment goal. In order to enhanceDeclaration of Trust of the Fund's investment flexibility, it is proposed thatWilmington Funds (the “Declaration of Trust”), the Fund's investment goal be reclassified as a "non-fundamental" policy, which means thatshareholders of each Fund will vote together on the proposal.

If shareholders of the Funds do not approve the Proposal, the Board will consider other alternatives. In addition, although the Trustees do not anticipate any other items of business being brought before the Meeting, the accompanying proxy gives discretionary authority to the persons named on the proxy with respect to any other matters that might properly be ablebrought before the Meeting. Those persons intend to change the Fund's investment goalvote all proxies in accordance with their best judgment and in the future without shareholder approval. Asinterest of the Trust and each Fund.

THE PROPOSAL: ELECTION OF TRUSTEES

At the Meeting, shareholders of the Trust will be asked to elect the following Current Trustees: Gregory P. Chandler, Donald E. Foley, Valerie J. Sill, and Eric W. Taylor, each to hold office during the continued lifetime of the Trust until he or she dies, resigns, retires, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed, or, if sooner than any of such events, until the next meeting of shareholders called for the purpose of electing Trustees and until their successors are duly elected and qualified.

At the meeting of the Board overseesof Trustees on December 7-8, 2023, the Board, at the recommendation of the Trust’s Nominating and Governance Committee, nominated each Current Trustee for election to the Board by the shareholders of the Trust. Information about each Current Trustee nominee is presented immediately below. The persons named in the accompanying form of proxy intend to vote at the Meeting (unless directed not to vote) FOR the election of Messrs. Chandler, Foley, and Taylor and Ms. Sill. Messrs. Chandler, Foley, and Taylor and Ms. Sill have indicated that they will continue to serve on the Board, and the Board has no reason to believe that Messrs. Chandler, Foley, and Taylor and Ms. Sill will become unavailable to continue to serve as Trustees. If the nominees are unavailable to serve for any reason, the persons named as proxies will vote for such other nominees nominated by the Independent Trustees.

Certain information regarding the Current Trustees as well as the executive officers of the Trust is set forth below. Each Trustee listed below, with the exception of Mr. Taylor, is not an “interested person” of the Trust, an investment adviser of a series of the Trust, or the underwriter of the Trust within the meaning of the Investment Advisor's implementationCompany Act of 1940, as amended (the “1940 Act”), and is referred to as an “Independent Trustee.” Mr. Taylor is an “interested person” of the investment strategiesTrust and the investment performanceadviser within the meaning of the Fund, this change would permit1940 Act and is referred to as an “Interested Trustee.” Unless otherwise indicated, the address of each Trustee and Officer of the Trust as it relates to the Trust’s business is 1100 North Market Street, 9th Floor, Wilmington, DE 19890.

2

CURRENT INTERESTED TRUSTEE

| | | | | | | | | | |

Name and

Date of Birth | | Position(s)

Held with the

Trust | | Term of

Office1 | | Principal

Occupation(s)

for the Past

Five Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee or

Nominee for

Trustee | | Other

Directorships

Held by

Trustee or

Nominee for

Trustee |

Eric W. Taylor Birth Date: 12/1981 | | Trustee President of the Trust | | Interested Trustee since 2022. President since 2022. | | Executive Vice President, Head of Investment Implementation and Investment Advisor Services, Manufacturers and Traders Trust Co. (2018 to Present). | | 10 | | None |

Mr. Taylor is an “Interested Trustee” due to his current affiliation with Wilmington Trust, N.A., a subsidiary of M&T Bank Corporation and parent company of Wilmington Funds Management Corporation and Wilmington Trust Investment Advisors, Inc., investment advisers to the Funds (together, the “Adviser”).

CURRENT INDEPENDENT TRUSTEES

| | | | | | | | | | |

Name and

Date of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length of

Service1 | | Principal

Occupation(s)

for Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee of

Nominee for

Trustee | | Other

Directorships

Held by

Trustee or

Nominee for

Trustee |

Gregory P. Chandler Birth Date: 12/1966 | | Trustee | | Independent Trustee since 2017. | | Chief Financial Officer, Herspiegel Consulting LLC (pharmaceutical consulting) (2020 to present); President, GCVC Consulting (financial and corporate governance advisory) (2008 to present); Chief Financial Officer, Avocado Systems, Inc. (cybersecurity software) (March 2020 to November 2020); Chief Financial Officer, Emtec, Inc. (information technology services) (2009 to 2020). | | 10 | | Trustee, RBB Fund Series Trust (34 portfolios) (registered investment companies) (2012 to present); Trustee, FS Specialty Lending Fund (business development company) (2009 to present); Director, Emtec, Inc. (2005 to 2019); Director, FS Investment Corporation (business development company) (2007 to 2019). |

3

| | | | | | | | | | |

Name and

Date of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length of

Service1 | | Principal

Occupation(s)

for Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee of

Nominee for

Trustee | | Other

Directorships

Held by

Trustee or

Nominee for

Trustee |

Donald E. Foley Birth Date: 8/1951 | | Chair Trustee | | Chair since 2023. Independent Trustee since 2018. Interested Trustee from 2015 to 2018. | | Director, BioSig Technologies (2015 to present); Trustee, AXA Premier VIP Trust (2017 to present); Trustee, EQ Advisors Trust (2014 to present); Trustee, 1290 Funds (2017 to present); Chairman and Director, Burke Rehabilitation Hospital Foundation (private hospital, research institute) (2005 to present); Trustee and Chairman of the President’s Council, Union College (private college) (2011 to present); Chairman and Trustee, New Beginning Family Academy (elementary charter school) (2016 to present). | | 10 | | Director, M&T Bank Corporation (commercial bank) (2011 to 2012); Chairman and Director, Wilmington Trust Corporation (commercial and trust bank) (2007 to 2011). |

4

| | | | | | | | | | |

Name and

Date of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length of

Service1 | | Principal

Occupation(s)

for Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee of

Nominee for

Trustee | | Other

Directorships

Held by

Trustee or

Nominee for

Trustee |

Valerie J. Sill Birth date: 5/1962 | | Trustee | | Independent Trustee since 2020. | | President, Chief Executive Officer and Chief Investment Officer, DuPont Capital Management (asset management) (2004 to present). | | 10 | | Trustee, Longwood Gardens (2005 to present); Trustee, Christiana Care Health System (2012 to 2021); and Advisory Counsel, Federal Reserve Bank of Philadelphia’s Economic Advisory Council (2010 to 2013). |

1 Each Trustee shall hold office for the lifetime of the Trust until he or she dies, resigns, retires, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed, or, if sooner than any of such events, until the next meeting of shareholders called for the purpose of electing Trustees and until his or her successor is duly elected and qualified. The tenure of each Independent Trustee is subject to the Board’s retirement policy, which states that a trustee shall retire from the Board on December 31 of the calendar year during which he or she turns 75 years of age.

CURRENT EXECUTIVE OFFICERS

| | | | | | |

Name and Date of

Birth | | Position(s) Held with

Trust | | Term of Office and

Length of Service | | Principal

Occupation(s) During

the Past Five Years |

Eric W. Taylor Birth Year: 1981 | | President | | Shall serve at the pleasure of the Board and until successor is elected and qualified. President since August 2022. | | Executive Vice President, Head of Investment Implementation and Investment Advisor Services, Manufacturers and Traders Trust Co. (2018 to Present). |

5

| | | | | | |

John C. McDonnell Birth Year: 1966 | | Chief Operations Officer and Vice President | | Shall serve at the pleasure of the Board and until successor is elected and qualified. Chief Operations Officer since June 2017. Vice President since June 2012. | | Chief Operations Officer, Wilmington Funds; Senior Vice President, Wilmington Funds Management Corporation (“WFMC”) (2005 to present); Senior Vice President, Wilmington Trust Investment Advisors, Inc. (“WTIA”) (2012 to present). |

| | | |

Kaushik Goswami Birth Year: 1973 | | Chief Compliance Officer and AML Compliance Officer | | Shall serve at the pleasure of the Board and until successor is elected and qualified. Chief Compliance Officer and AML Compliance Officer since October 2021. | | Chief Compliance Officer and Anti-Money Laundering Officer, Wilmington Funds (2021 to present); Senior Vice President, M&T Bank. |

| | | |

John J. Kelley Birth Year: 1959 | | Vice President | | Shall serve at the pleasure of the Board and until successor is elected and qualified. Vice President since December 2016. | | President, WFMC; Senior Vice President and Chief Administrative Officer, WTIA. |

| | | |

Robert L. Tuleya Birth Year: 1974 | | Vice President and Assistant Secretary | | Shall serve at the pleasure of the Board and until successor is elected and qualified. Vice President and Assistant Secretary since September 2018. | | Senior Vice President and Assistant Secretary, Wilmington Funds; Senior Vice President and Assistant Secretary, WFMC (2018 to present); Senior Vice President and Assistant Secretary, WTIA (2018 to present); Senior Vice President and Assistant Secretary, Wilmington Trust Investment Management, LLC (2018 to present); Senior Vice President and Assistant General Counsel, M&T Bank (2018 to present). |

| | | |

Charles S. Todd Three Canal Plaza,

Suite 100 Portland ME 04101 Birth Year: 1971 | | Chief Executive Officer | | Shall serve at the pleasure of the Board and until successor is elected and qualified. Chief Executive Officer since June 2022. | | Managing Director, Fund Officers, ACA Group, previously Foreside Financial Group (2008 to present). |

6

| | | | | | |

Lisa R. Grosswirth 240 Greenwich Street, 22nd Floor New York, NY 10286 Birth Year: 1963 | | Secretary | | Shall serve at the pleasure of the Board and until successor is elected and qualified. Secretary since September 2007. | | Vice President, BNY Mellon Asset Servicing (2004 to present). |

| | | |

Arthur W. Jasion Three Canal Plaza, Suite 100 Portland, ME 04101 Birth Year: 1965 | | Chief Financial Officer and Treasurer | | Shall serve at the pleasure of the Board and until successor is elected and qualified. Chief Financial Officer and Treasurer since October 2020. | | Senior Principal Consultant and Fund Principal Financial Officer, ACA Group, previously Foreside Financial Group (2020 to present). |

BOARD LEADERSHIP STRUCTURE

The Board of Trustees is composed of four Independent Trustees, including Nicholas A. Giordano who is retiring effective December 31, 2023, and one Interested Trustee. Donald E. Foley, Independent Trustee, serves as the Chairman of the Board and presides at meetings of the Board. Mr. Foley regularly communicates with representatives of the Adviser and the Trust. Mr. Foley leads the deliberative meetings of the Independent Trustees that are held outside of the presence of management personnel. The Independent Trustees are advised at these meetings, as well as at other times, by separate, independent legal counsel. Mr. Foley may perform such other functions as may be requested by the Board from time to modify the investment goal if thetime. The Board believes that suchhaving a change would besuper-majority of Independent Trustees, coupled with an Independent Chairman, is appropriate and in the best interests of the Fund. ReclassifyingTrust, given its specific characteristics.

The Trustees have the authority to take all actions necessary in connection with the business affairs of the Trust, including, among other things, approving the investment goalgoals, policies and procedures for the Funds. The Trust enters into agreements with various entities to manage the day-to-day operations of the Funds, including with the Adviser, the sub-advisers, the administrator, the transfer agent, the distributor and the custodian. The Trustees are responsible for approving these service providers, approving the terms of their contracts with the Funds, and exercising general oversight of these service providers on an ongoing basis.

COMMITTEES OF THE BOARD

| | | | | | |

Board Committee | | Committee Members | | Committee Functions | | Meetings Held During Last Fiscal Year |

| Audit | | Gregory P. Chandler, Chair Donald E. Foley Valerie J. Sill | | The purposes of the Audit Committee are to oversee the accounting and financial reporting processes of the Funds, the Funds’ internal control over financial reporting and the quality and integrity of the independent audit of the Funds’ financial statements. The Audit Committee also oversees or assists the | | Four |

7

| | | | | | |

Board Committee | | Committee Members | | Committee Functions | | Meetings Held During Last Fiscal Year |

| | | | Board with the oversight of compliance with legal requirements relating to those matters, approves the engagement and reviews the qualifications, independence and performance of the Funds’ independent registered public accountants, acts as a liaison between the independent registered public accountants and the Board and reviews the Funds’ internal audit function. | | |

| | | |

| Nominating and Governance | | Valerie J. Sill, Chair Gregory P. Chandler Donald E. Foley | | The Nominating and Governance Committee, whose members are all Independent Trustees, selects and nominates persons for election to the Trust’s Board when vacancies occur. The Nominating and Governance Committee will consider candidates recommended by shareholders, Independent Trustees, officers or employees of any of the Funds’ agents or service providers and counsel to the Trust. Any shareholder who desires to have an individual considered for nomination by the Nominating and Governance Committee must submit a recommendation in writing to the Secretary of the Trust, at 1100 North Market Street, 9th Floor, Wilmington, DE 19890. The recommendation should include the name and address of both the shareholder and the candidate and detailed information concerning the candidate’s qualifications and experience. In identifying and evaluating candidates for consideration, the Nominating and Governance Committee shall consider such factors as it deems appropriate. Those factors will ordinarily include integrity, intelligence, collegiality, judgment, diversity, skill, business and other experience, qualification as an “Independent Trustee,” the existence of material relationships which may create the appearance of a lack of independence, financial or accounting knowledge and experience and dedication and willingness to devote the time and | | Four |

8

| | | | | | |

Board Committee | | Committee Members | | Committee Functions | | Meetings Held During Last Fiscal Year |

| | | | attention necessary to fulfill Board responsibilities. In addition, the Nominating and Governance Committee provides a forum for the Independent Trustees to address important issues of corporate governance for the Trust, including Trustee compensation and the Board self-evaluation, and to make appropriate recommendations to the full Board regarding sound governance practices. The Board has adopted and approved a formal written charter for the Nominating and Governance Committee. A copy of the Nominating and Governance Committee Charter is included herein as Appendix A. | | |

EXPERIENCE OF TRUSTEES

Described below for each Trustee are specific experiences, qualifications, attributes or skills that support a conclusion that he or she should serve as a non-fundamental policy would also alleviate the time and expense associated with holding a shareholder meeting and soliciting proxies in conjunction with any future material changeTrustee of the Fund's investment goal. However,Trust as of the Fund still intendsdate of this proxy statement and in light of the Trust’s business and structure. The role of an effective Trustee inherently requires certain personal qualities, such as integrity, as well as the ability to notify shareholderscomprehend, discuss and critically analyze materials and issues that are presented so that the Trustee may exercise judgment and reach conclusions in advancefulfilling his or her duties and fiduciary obligations. It is believed that the specific background of any future material changeeach Trustee evidences those abilities and is appropriate to his or her serving on the Fund's investment goal. If shareholders approve this Proposal 2, the Fund also would discloseTrust’s Board of Trustees. Further information about each Trustee is set forth in the Fund's prospectus thattable above describing the investment goalbusiness activities of and other directorships held by each Trustee during the Fund is non-fundamental and may be changed by the Board without a vote of shareholders. The Board currently does not intend to change the Fund's investment goal other than as described in Proposal 1.

What is the required vote on Proposal 2?

5

To reclassify the Fund's investment goal as "non-fundamental," Proposal 2 must be approved by shareholders of the Fund by a 1940 Act Vote, as described on page [4]. If shareholders do not approve Proposal 2, the Fund's investment goal will continue to be fundamental and the Board will be required to seek shareholder approval if, in the future, it decides to materially change either the investment goal or again attempt to reclassify the investment goal from fundamental to non-fundamental. If approved by shareholders of the Fund, the proposed reclassification of the Fund's investment goal from "fundamental" to "non-fundamental" would become effective on or about [ January 31, 2017].

THE BOARD UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE "FOR" PROPOSAL 2.

♦ ADDITIONAL INFORMATION ABOUT THE FUND

The Investment Advisor. Wilmington Fund Management Corporation, 1100 N. Market Street, Wilmington, DE 19890, is the Fund's Investment Advisor WFMC and entities affiliated with WFMC or its predecessors havepast five years.Interested Trustee

Mr. Taylor has served as investment advisor to certain of fundsa Trustee of the Trust since 1988October 2022 and asPresident of June 30, 2016, it managed approximately $11.2 billion in assets.

The Investment Advisor is a wholly owned subsidiary of Wilmington Trust Corporation, which is a wholly owned subsidiary of M&T Bank Corporation.The Sub-Advisor. Wilmington Trust Investment Advisors, Inc., 111 South Calvert Street, 26th Floor, Baltimore, MD 21202, is the Fund's Sub-Advisor. The Sub-Advisor provides certain investment services, information, advice, assistance and facilities and performs research, statistical and investment services pursuant to a sub-advisory agreement among the Trust the Investment Advisor and the Sub-Advisor. The Sub-Advisor is an affiliate of the Investment Advisor and is a wholly owned subsidiary of Manufacturers Traders Trust Company, which is a wholly owned subsidiary of M&T Bank Corporation.

Third-Party Sub-Advisors:

Analytic Investors, LLC ("Analytic") sub-advises a portion of the Fund. Analytic, located at 555 West Fifth Street, 50th Floor, Los Angeles, California 90013, is a registered investment advisor.

Highland Capital Healthcare Advisors, L.P. ("HCHA") sub-advises a portion of the Fund. HCHA, located at 300 Crescent Court, Suite 700, Dallas, Texas 75201, is a registered investment advisor.

Highland Capital Management Fund Advisors, L.P. ("HCMFA") sub-advises a portion of the Fund. HCMFA, located at 200 Crescent Court, Suite 700, Dallas, Texas 75201, is a registered investment advisor.

Parametric Risk Advisors LLC ("PRA") sub-advises a portion of the Fund. PRA, located at 518 Riverside Avenue, Westport, CT 06880, is a registered investment advisor.

P/E Global LLC ("PE Global") sub-advises a portion of the Fund. PE Global, located at 75 State Street, 31st Floor, Boston, MA 02109, is a registered investment advisor.

Shelton Capital Management ("Shelton") sub-advises a portion of the Fund. Shelton, located at 1050 17th Street, Suite 1710, Denver, CO 80265, is a registered investment advisor.

6

Co-Administrators. WFMC and BNY Mellon Investment Servicing (U.S.) Inc. ("BNYM") servesince August 2022, while acting as co-administrators to the Trust and provide the Fund with administrative personnel and services necessary to operate the Fund. BNYM, with its principal address at 301 Bellevue Parkway, Wilmington, DE 19809, also provides fund accounting services to the Fund.

For providing administrative services to the Fund, WFMC receives the following annual fee, based on the average daily net assets held in all portfolios of the Trust:

Maximum Administrative Fee | Average Aggregate Daily Net Assets of the Wilmington Funds |

0.040% | on the first $5 billion |

0.030% | on the next $2 billion ($5 – 7 billion) |

0.025% | on the next $3 billion ($7 – 10 billion) |

0.018% | on assets in excess of $10 billion |

For providing administrative and accounting services to the Fund, BNYM receives the following annual fee, based on the average net assets held in all portfolios of the Trust:

Annual Fee, Billed and Payable Monthly

| Average Monthly Net Assets of the Wilmington Funds |

0.0285% | on the first $500 million |

0.0280% | on the next $500 million |

0.0275% | on assets in excess of $1 billion |

For its services as fund accountant and co-administrator for the fiscal year ending April 30, 2016, the Fund paid BNYM $47,990 in fees.

The Distributor. The distributor for the Fund is ALPS Distributors, Inc. ("Distributor"), with its principal address at 1290 Broadway, Suite 1100, Denver, Colorado 80203. Under the Distributor's contract with the Trust, the Distributor offers shares on a continuous, best-efforts basis, including shares of the Fund.

The Distributor receives a front-end sales charge on certain share sales. The Distributor generally pays up to 90% (and as much as 100%) of this charge to investment professionals for sales and/or administrative services. The Distributor retains any portion not paid to an investment professional, and makes this available for marketing and sales-related activities and expenses, including those of the Investment Advisor and its affiliates. Furthermore, the Distributor may receive compensation from 12b-1 fees pursuant to a Rule 12b-1 Plan for activities principally intended to result in the sale of shares such as advertising and marketing of shares, including printing and disseminating prospectuses and sales literature to prospective shareholders and financial intermediaries. The Distributor may also receive a monthly fee, computed at an annual rate not to exceed 0.25% of 1% of the average aggregate net asset value of the shares of the Fund held during the month, for providing shareholder services and maintaining shareholder accounts. In addition to the Rule 12b-1 and/or shareholder services fees that a Fund may pay to financial intermediaries, the Distributor and the Investment Advisor and their affiliates may pay out of their own reasonable resources and legitimate profits amounts, including items of material value, to certain financial intermediaries.

The following chart reflects the total sales charges paid to M&T Securities,Executive Vice President, Manufacturers and Traders Trust Company,

as Head of Investment Implementation and Investment Advisor Services, and previously, as Director of Investment Planning and Portfolio Implementation, Regional Investment Advisory Lead & Regional Investment Implementation Officer, and Senior Investment Advisor. His current position within the M&T organization entails significant responsibilities.Independent Trustees

Mr. Chandler has served as an Independent Trustee of the Trust since July 2017. He has significant experience related to the business and financial services industries and currently serves as a Trustee to the RBB Fund Series Trust and as a Trustee to FS Specialty Lending Fund. Mr. Chandler is also Chief Financial Officer of Herspiegel Consulting LLC. He presently serves as Chair of the Audit Committee of the Trust.

9

Mr. Foley has served as a Trustee of the Trust since December 2015. He has significant experience related to the business and financial services industries, having previously served as an Advisory Member of the Trust and Investment Committee of M&T Bank, Wilmington Trust, National Association, and Wilmington Trust RetirementCompany. He currently serves on the Board of Directors of AXA Equitable and Investment Services, affiliates1290 Mutual Funds. He previously served as a Director of M&T Bank Corporation and M&T Bank and was Chairman and Chief Executive officer of Wilmington Trust Corporation. Mr. Foley presently serves as Chairman of the Investment Advisor, in connection with the sale of Class A SharesBoard of the FundTrust.

Ms. Sill has served as an Independent Trustee of the Trust since April 2020. She has significant experience related to the business and financial services industries, being the amount retained byPresident, Chief Executive Officer and Chief Investment Officer of DuPont Capital Management, an asset management firm. She has also served as a trustee to other firms, as well as Advisory Counsel to the Distributor for the fiscal year ended April 30, 2016:

7

Fiscal Year Ended | Total

Sales Charges

($)

| Amount

Retained by

Distributor

($)

|

April 30, 2016 | 143 | - |

The Transfer Agent. The transfer and dividend disbursing agent for the Fund is BNYM. BNYM receives a separate fee from the Fund, based on a per shareholder account basis, for providing transfer agency services.

The Custodian. The custodian for the Fund is TheFederal Reserve Bank of New York MellonPhiladelphia’s Economic Advisory Council. Ms. Sill presently serves as Chair of the Nominating and Governance Committee of the Trust.The Board believes that each Trustee’s experience, qualifications, attributes and skills should be evaluated on an individual basis and in consideration of the perspective such Trustee brings to the entire Board, with principal address at One Wall Street, New York, NY 10286.

Other Matters. The Fund's audited financial statementsno single Trustee, or particular factor, being indicative of Board effectiveness. However, the Board believes that Trustees need to have the ability to critically review, evaluate, question and annual report for its last completed fiscal year,discuss information provided to them, and any subsequent semi-annual report to shareholders, are available free of charge. To obtain a copy, please call [(800) 836-2211; visit www.wilmingtonfunds.com; writeinteract effectively with Fund management, service providers and counsel, in order to Wilmington Funds, P.O. Box 9828, Providence, RI 02940-8025; orexercise effective business judgment in the Buffalo, NY area call (716) 635-9368].performance of their duties. The Board believes that its members satisfy this standard.Experience relevant to having this ability may be achieved through a Trustee’s educational background; business, professional training or practice; public service or academic positions; experience from service as a board member (including the Board) or as an executive of investment funds, public companies or significant private or non-profit entities

Outstanding Shares or other organizations; and/or other life experiences.To assist them in evaluating matters under federal and Principal Shareholders

. state law, the Independent Trustees may benefit from information provided by counsel to the Trust. The outstanding sharesBoard and classesits committees have the ability to engage other experts as appropriate. The Board evaluates its performance on an annual basis.BOARD OVERSIGHT OF TRUST RISK

The Board has not established a formal risk committee. However, much of the Fund asregular work of the Record Date are set forth in Exhibit A.

The namesBoard and its standing Committees addresses aspects of shareholders that owned beneficially 5% or more ofrisk oversight. At each regular Board meeting, the outstanding shares ofAdviser reports to the Fund as offull Board on actual and potential risks to the Record Date are set forth in Exhibit B. From time to time, the number of shares held in "street name" accounts of various securities dealers for the benefit of their clients may exceed 5% of the total shares outstanding of any class of the Fund. To the knowledge of the Fund's management, as of the Record Date, there were no other entities, except as set forth in Exhibit B, owning beneficially more than 5% of the outstanding shares of any class of the Fund.

As of the [Record Date], the TrusteesFunds and

officers of the Trust as a

whole. In addition, as part of its regular quarterly reports to the Board about various matters, the Adviser reports to the Board on the various elements of risk, including investment risk, credit risk, liquidity risk and operational risk, as well as overall business risks relating to the Fund. In addition, the Audit Committee considers risks related to financial reporting and controls.The Board has appointed a Chief Compliance Officer (the “CCO”) who reports directly to the Board’s Independent Trustees and provides presentations to the Board at its quarterly meetings and an annual report to the Board concerning compliance matters. The CCO oversees the development and implementation of compliance policies and procedures that are reasonably designed to prevent violations of the federal securities laws (the “Compliance Policies”). The Board has approved the Compliance Policies, which seek to reduce risks relating to the possibility of non-compliance with the federal securities laws. The CCO also regularly discusses the relevant risk issues affecting the Trust during private meetings with the Independent Trustees, including concerning the Adviser, as applicable.

10

SECURITY AND OTHER INTERESTS

The following table sets forth the dollar range of equity securities beneficially owned by each Trustee in each Fund and in all registered investment companies overseen by the Trustee within the Fund complex, as of December 31, 2022.

| | | | | | | | |

| NOMINEE | | DOLLAR RANGE OF EQUITY

SECURITIES IN THE FUNDS | | | AGGREGATE DOLLAR

RANGE OF EQUITIY

SECURITIES IN ALL FUNDS

OVERSEEN OR TO BE

OVERSEEN BY NOMINEE IN

THE TRUST | |

Interested Board Member | | | | | | | | |

Eric W. Taylor | | | None | | | | None | |

| | |

Independent Board Members | | | | | | | | |

Gregory P. Chandler | | | | | | | Over $100,000 | |

Wilmington Enhanced Dividend Income Strategy Fund | | | Over $100,000 | | | | | |

Wilmington Broad Market Bond Fund | | | $1-$10,000 | | | | | |

Wilmington International Fund | | | $50,001-$100,000 | | | | | |

Wilmington Large Cap Strategy Fund | | | $10,001-$50,000 | | | | | |

Wilmington Real Asset Fund | | | $1-$10,000 | | | | | |

Wilmington Global Alpha Equities Fund | | | $50,001-$100,000 | | | | | |

Wilmington Municipal Bond Fund | | | $1-$10,000 | | | | | |

| | |

Donald E. Foley | | | | | | | Over $100,000 | |

Wilmington Global Alpha Equities Fund | | | $10,001-$50,000 | | | | | |

Wilmington International Fund | | | $10,001-$50,000 | | | | | |

Wilmington Large-Cap Strategy Fund | | | $50,001-$100,000 | | | | | |

| | |

Valerie J. Sill | | | | | | | Over $100,000 | |

Wilmington Large-Cap Strategy Fund | | | Over $100,000 | | | | | |

As of December 31, 2022, the Fund’s Board and Officers as a group owned 2% of the Wilmington Enhanced Dividend Income Strategy Fund’s outstanding shares and less than 1% of the outstanding shares of each class of the Fund.

♦ FURTHER INFORMATION ABOUT VOTING AND THE MEETING

Solicitation of Proxies. Your vote is being solicited byother Funds.COMPENSATION

In addition to the Board. The total cost of proxy solicitation is estimated to be approximately $[40,000], includingfees below, the Trust reimburses the Independent Trustees for their related business expenses. The cost of soliciting proxies will be borne byfollowing table shows the Fund. fees paid to the Trustees during the fiscal year ended April 30, 2023.

11

| | | | | | | | | | | | | | | | |

TRUSTEE | | AGGREGATE

COMPENSATION

FROM THE

TRUST | | | PENSION OR

RETIREMENT

BENEFITS

ACCRUED AS

PART OF THE

TRUST

EXPENSES | | | ESTIMATED

ANNUAL

BENEFITS UPON

RETIREMENT | | | TOTAL

COMPENSATION

FROM FUND

COMPLEX PAID

TO THE

TRUSTEE | |

Eric W. Taylor | | | None | | | | None | | | | None | | | | None | |

Nicholas A. Giordano | | $ | 150,250 | | | | None | | | | None | | | $ | 150,250 | |

Gregory P. Chandler | | $ | 142,500 | | | | None | | | | None | | | $ | 142,500 | |

Donald E. Foley | | $ | 143,375 | | | | None | | | | None | | | $ | 143,375 | |

Valerie J. Sill | | $ | 133,375 | | | | None | | | | None | | | $ | 133,375 | |

The Trust also will reimburse brokerage firms and othersdoes not maintain any pension or retirement plans for the officers or Trustees of the Trust.

SHAREHOLDER COMMUNICATIONS WITH TRUSTEES

Shareholders who wish to communicate in writing with the Board or any Trustee may do so by sending their expenses in forwarding proxy materialswritten correspondence addressed to the beneficial owners of sharesBoard or the Trustee to Wilmington Funds, Attn: Lisa R. Grosswirth, c/o BNY Mellon, 240 Greenwich Street, 22nd Floor, New York, NY 10286.

REQUIRED VOTE

Approval of the Fund and soliciting themProposal requires a plurality of votes cast at a shareholders’ meeting at which quorum is present. According to execute proxies. Thethe Trust’s Declaration of Trust, expects that the solicitation will be primarily by mail, but may also include telephone, facsimile, electronic or other means of communication. Trustees and officers of the Trust, and regular employees and agents of the Investment Advisor or its affiliates involved in the solicitation of proxies are not reimbursed.

Voting by Broker-Dealers. The Trust expects that, before the Meeting, broker-dealer firms holding shares of the Fund in "street name" for the broker-dealer firms' customers will request voting instructions from their customers and beneficial owners. If these instructions are not received by the date specified in the broker-dealer firms' proxy solicitation materials, the Trust understands that broker-dealers may not vote on the Proposals. Certain broker-dealers may exercise discretion over shares held in the broker-dealer firms' names for which no instructions are received by voting these shares in the same proportion as the broker-dealer firms vote shares for which they received instructions.

Quorum. The holders of 33 1/3% of the outstanding shares of the Fund entitled to vote at the Meeting, present in person or represented by proxy constitutesand entitled to vote at a shareholders’ meeting shall constitute a quorum at such meeting for purposes of this vote.As of December 13, 2023, the record date for the Special Meeting, more than 50% of the Trust’s outstanding shares are held in asset management, trust, custody or brokerage accounts with respect to which affiliates of the Advisor have voting discretion. The Adviser expects shares held in such accounts will be voted in favor of the proposal.

The Board recommends that shareholders of the Funds vote FOR the election of the Current Trustees.

OTHER BUSINESS

The Trustees know of no other business to be presented at the Special Meeting other than the Proposal, and do not intend to bring any other matters before the Special Meeting. However, if any additional matters should be properly presented, proxies will be voted or not voted as specified. Proxies reflecting no specifications will be voted in favor of the election of the Current Trustees and in favor of the election of the New Trustee and, as to any other matter properly coming before the meeting, in accordance with the judgment of the persons named in the proxy.

ADDITIONAL INFORMATION

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PricewaterhouseCoopers LLP (“PWC”), Two Commerce Square, 2001 Market Street, Suite 1800, Philadelphia, Pennsylvania 19103, has been selected by the Trustees, including a majority of the Independent Trustees, to serve as the Trust’s independent registered public accounting firm for the Trust’s fiscal year ending April 30, 2023. PWC, in accordance with the Public Company Accounting Oversight Board’s Ethics and Independence Rule 3526, has confirmed to the Audit Committee that it is an

12

independent registered public accounting firm with respect to the Trust and each series of the Trust. The Audit Committee has approved the engagement of PWC as the Trust’s independent registered public accounting firm for the current fiscal year. A representative of PWC will not be present at the Meeting. For the fiscal year ended April 30, 2023, PWC received “audit fees,” “audit-related fees,” “tax fees” and “all other fees” in the amounts of $408,843, $0, $90,778 and $0, respectively.1 For the fiscal year ended April 30, 2022, PWC received “audit fees,” “audit-related fees,” “tax fees” and “all other fees” in the amounts of $396,560, $0, $131,920 and $0, respectively.

Prior to the commencement of any engagement, the Audit Committee is required to approve the engagement of the independent registered public accounting firm to provide audit or non-audit services to the Funds, or to provide non-audit services to any investment adviser, sub-adviser or any entity controlling, controlled by, or under common control with the investment adviser or sub-adviser that provides ongoing services to the Trust if the engagement relates directly to the operations and financial reporting of the Trust. If action is required prior to the next Audit Committee meeting, the Chair of the Audit Committee may approve or deny the request on behalf of the Audit Committee or determine to call a meeting of the Audit Committee. If the Chair of the Audit Committee is unavailable, any other member of the Audit Committee to whom the Audit Committee has delegated authority may serve as an alternate for the purpose of approving or denying the request. All of the audit, audit-related and tax services described above for which PWC billed the Trust fees for the fiscal year ended April 30, 2023 were pre-approved by the Audit Committee.

There were no services rendered by PWC to the Trust or its series for which the approval requirement was waived. During the same period, all services provided by PWC to the Trust, its series, an investment adviser or adviser-affiliate that were required to be approved were approved as required. The Audit Committee has considered whether the provision of non-audit services that were rendered by PWC to an investment adviser or an adviser-affiliate that were not approved (not requiring approval), if any, is compatible with maintaining PWC’s independence.

The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the Trust or its, and rendered to the Trust’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Trust for the fiscal years ended April 30, 2023 and April 30, 2022 and were $90,778 and $131,920, respectively.

ADDITIONAL SERVICE PROVIDERS

The service providers currently engaged by the Trust with respect to the Funds to perform non-advisory services will continue to serve the Trust in the capacities indicated below:

| 1 | “Audit fees” are fees related to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. “Audit-related fees” are fees related to assurance and related services that are reasonably related to the performance of the audit or review of financial statements, but not reported under “Audit Fees,” including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters and internal control reviews not required by regulators. “Tax fees” are fees associated with tax compliance, tax advice and tax planning, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews and tax distribution and analysis reviews. “All other fees” are fees for products and services provided to the Trust other than those reported under “audit fees,” “audit-related fees” and “tax fees.” |

13

Distributor

ALPS Distributors, Inc.

1290 Broadway, Suite 1100

Denver, Colorado 80203

Investment Adviser and Co-Administrator

Wilmington Funds Management Corporation

1100 North Market Street, 9th Floor

Wilmington, Delaware 19890

Transfer Agent, Co-Administrator, Accountant and Custodian

The Bank of New York Mellon

301 Bellevue Parkway

Wilmington, Delaware 19809

Legal Counsel

Stradley Ronon Stevens & Young, LLP

Financial Printers

DFIN Solutions

VOTING AND SOLICITATION INFORMATION